Sam Brodey at MinnPost: From the people who just brought you a big increase in the federal budget deficit: a balanced budget amendment discusses this most laughable concept. Given that Trump and the GOP just signed a huge unpaid for tax cut, and a big spending bill.

Now I never understand how current adults are okay with free loading and passing our bills to our kids via a ballooning National debt... I find that to be irresponsible and definitely not a measure of the "better" party / President... " Thoughts?

ZH JP Morgan Sounds Alarm

Now I never understand how current adults are okay with free loading and passing our bills to our kids via a ballooning National debt... I find that to be irresponsible and definitely not a measure of the "better" party / President... " Thoughts?

ZH JP Morgan Sounds Alarm

Republicans favor a balanced budget amendment because it removes the blame from them for the hard decisions that would be required were it ever passed, but they are too afraid to advocate for on their own.

ReplyDeleteThis part frustrated me greatly...

ReplyDelete"To some Republicans, a constitutional imperative to force belt-tightening might be the only way, at this point, to rein in Washington. Second District Rep. Jason Lewis, who voted against the budget deal but for the tax cuts, said the balanced budget amendment is “a realization on the part of the institution that we need to force some willpower here… I believe the fundamental problem here is there’s not a political penalty for increasing spending, but there’s a severe political penalty for reducing spending.”

“Until we can get that paradigm shifted, we’re going to have to do something,” Lewis said. The freshman congressman said he’d enthusiastically support an amendment to require the government to balance its budget, if it were accompanied with language requiring reductions in spending, so that lawmakers could not get around spending cuts by instituting tax increases.

To critics, the balanced budget amendment is a cynical ploy to give Republicans some cover on the campaign trail as they try to save the GOP’s branding as the party of fiscal responsibility."

As I told Jerry elsewhere when he said he wants a balanced budget...

ReplyDelete"The Liberals also want A LOT of things...

That does not mean they want it bad enough to make the sacrifices needed to see it happen.

Is that like someone saying they want a better paying job...

While being unwilling to learn, work harder, change companies, etc?

Would it be better if I said...

"Now I realize you are willing to accept free loading and passing the bills to our kids... "

That discussion is happening at G2A Trump Lies by the way.

ReplyDelete"To critics, the balanced budget amendment is a cynical ploy to give Republicans some cover on the campaign trail as they try to save the GOP’s branding as the party of fiscal responsibility."

ReplyDeleteCynical ploys are the essence of Republican governance these days.

Trump is great with debt. Our president doesn't take questions, but if he did, it might be interesting to get his views about the uses of leverage. If high debt levels work for him, why an't they work for the rest of us? Is our economy so different from his?

ReplyDeleteI am a bit surprised to hear this talk about the balanced budget. Deficits are generally something we worry about when Democrats are in charge. While I would suggest that paying down debts when times are good, when, by the way, inflation is present which makes paying down debt cheaper makes some sense, that's a policy we have rejected. We are cutting, not raising taxes, increasing, not reducing our spending. Adding more language to the constitution won't change the politics, and it's the politics that matter.

--Hiram

Conservatives want lots of stuff, aircraft carreiers and what not. Walls and armies on borders are big with them, electricity in Puerto Rico, not so much.

ReplyDelete--Hiram

Back to one of my favorites.

ReplyDelete"Some will argue that we are now off the 18% revenue trend line and need to repeal the Bush tax cuts to get back there. I am not sure this is the case, but I think a lot of us would be willing to go back to a pre-Bush tax regime if we could also be guaranteed to go back to a pre-Bush spending regime as well. Unfortunately, any deal linking the two is inherently untrustworthy, as politicians have a near 100% success rate in fulfilling promises to raise taxes, but are not so good when it comes to making promised spending reductions real.

Why? Well, we could have a 2-hour lecture here on government budget processes and the inability to tie the hands of future Congresses, but I will answer in a slightly different way. Take the chart above, and re-label the Y-axis -- instead of size of budgets as percent of GDP, lets just label it "government power." Which way do you think politicians want the line to go? Up or down?

The political incentives are for these lines to always go up, which is why the spending line has gone up almost irrespective of the party in charge for 60 years."

To be fair though... It is the current citizens who demand "low taxes" and "high benefits"...

ReplyDeleteI mean why not when the bill won't come due for decades?

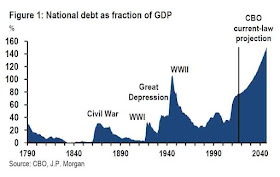

Just look at that Debt Grow.

We are like someone with a shoe fetish and a credit card that the Daddy is supposed to pay. :-(

"It is the current citizens who demand "low taxes" and "high benefits"..."

ReplyDeleteMostly Conservatives. You don't hear Liberals talking like this. We want to actually pay for the things the government does.

Moose

Yet conservatives say they want a balanced budget? Why do you suppose liberals and conservatives cannot agree? Hint: look up "magical mystical money tree in DC" and see who waters it.

ReplyDeleteMoose,

ReplyDeleteNow that is malarkey... I did not see any middle class or poor people begging for Congress to let the "Bush Tax Cuts" lapse that benefitted them. The Liberals just demanded that the cuts that benefitted the wealthy be allowed to lapse.

I did not see the Liberals saying... Let's all pitch in to fund ACA, they said let's make the wealthy pay for it...

Jerry,

Well both sides contribute by using the "GOP's Tax Cuts Yield More Revenue Bull****" to fertilize the "DEM's Magical Money Tree". And so the deficits continue and the debt grows.

People don't believe in the need for balanced budgets. It's just something they say for political reasons. It's so much wool to be pulled over the eyes of the naive.

ReplyDelete==Hiram

Who are these people you are talking about?

ReplyDelete"don't believe in the need for balanced budgets"

The greedy self serving voters of today?

Or???

My comment at MP.

ReplyDelete"History has shown that both parties contributed to the mess we are leaving our children. And yes the GOP talking balanced budgets after passing the recent tax cut and spending bill is about as hypocritical as one can get.

I never understand how our current voting adults are okay with OUR free loading and passing OUR bills to our kids via a ballooning National debt. I find that to be terrible and definitely not a measure of responsibility or success.

And yet the folks on the Left keep voting for people who promise protection, regulation, free services, free money, etc (ie spending other peoples money). And the folks on the Right keep voting for people who promise different regulations and tax cuts. (ie shorting revenues)

I hope our kids, grand kids and great grand kids forgive our generations for our

selfishness. "

Republicans just passed what they tell us is the largest tax cut in history. That's not what you do if you are concerned about deficits.

ReplyDelete==Hiram

OK, so if "both sides do it"-- a proposition I strongly believe is NOT equal-- then how will the budget ever be "balanced" without a law requiring it to be so? 49 states have some sort of balanced budget requirement. What sort of discipline or stricture that puts on the legislative branch to do its job I do not know nor care; it is their job. The discipline in Congress is simply absent. If a BBA does any good at restoring that, let us have it.

ReplyDeleteI still believe the better way is for Congress to develop that self-control and restraint, and balance the budget by reforming the many programs it has created, with flowery good intentions, over the years but that do not work as intended.

"I did not see the Liberals saying... Let's all pitch in to fund ACA, they said let's make the wealthy pay for it..."

ReplyDeleteThat's not entirely true. The "Cadillac Tax" provision, for instance, would hit union health plans particularly hard if it were ever allowed to be implemented. And certainly the proposals for "Medicare for All" would require some form of broad-based taxation to implement, yet many Democrats are flocking towards that as a policy.

Hiram, Agreed.

ReplyDeleteJerry, I support a BBA. And I don't blame the politicians. I blame us voters.

Sean, I'll keep an eye out for the non-Progressive Tax proposal from the Left... The only ones I have seen so far are sales taxes, sin taxes, etc.

I am not sure how many or who would be impacted by the Cadillac Insurance Tax

Sean,

ReplyDeleteMaybe the Cadillac tax is like when my Liberal friend complained about how high his cabin taxes were, and that he was not allowed to vote on the local school referendum.

I told him, welcome to be one of the "rich"... :-)

Never understood this animus toward progressive taxes. However fair it might be, a per capita tax doesn't work because it doesn't raise enough money. It didn't work in Russia when it was tried. You could tell because it resulted in all their politicians either getting shot or being sent to Gulags.

ReplyDelete--Hiram

A progressive tax is one thing, but an overly progressive tax is another. There is a simple solution-- a flat tax with a "family" exclusion. Tax all "disposable" income at one flat rate, and the tax is then perfectly progressive. Progressives won't like it because it doesn't "punish" the rich like the current scheme does, nor will they be able to hide massive social engineering in its simplicity.

ReplyDelete"Sean, I'll keep an eye out for the non-Progressive Tax proposal from the Left. The only ones I have seen so far are sales taxes, sin taxes, etc."

ReplyDeleteSo you haven't seen non-progressive tax proposals from the left, except for the ones you've already seen. Got it.

But if you're looking for a specific answer, one of the methods proposed by Bernie Sanders to pay for his vision of M4A is an increased payroll tax, which is not progressive.

ReplyDeleteSean,

ReplyDeleteCheckout the How for we Pay for it section.

It looks pretty progressive.

to me it seems very simple - the greater the inequality in our country the more progressive the tax code should be. Right now I think the rich should be paying more, that the tax code is not progressive enough. I would put the top bracket at 50%

ReplyDeleteLaurie,

ReplyDeleteNow that sounds more like the Liberal view I am familiar with.

So what would you do about the spending side of the equation?

Remember the problem we have is"

Spending - Revenues > $0 = deficit

" In contrast, the top 1 percent of all taxpayers (taxpayers with AGIs of $465,626 and above) earned 20.58 percent of all AGI in 2014, but paid 39.48 percent of all federal income taxes."

ReplyDeleteDoes that sound fair to anybody?

Yes... :-)

ReplyDeleteThe Effective Tax Rates by Income Here explain it better.

ReplyDeleteThe only problem with the graph is that the >$10 million people should be paying about 33%, so they are some what more than the income level below them.

I just about fell off my chair when I saw John support progressive taxes.

ReplyDeleteabout spending- off the top of my head I think I would cut spending by very little.

I am much more in favor of decreasing the defict by raising taxes.

I think I would make almost everyone pay more for SS and medicare and perhaps make these programs more generous for lower income recipients.

Math, Laurie. Again, I think I would cut spending by about 50%, while continuing benefits at the current level by reforming all these wasteful programs. And the point is that it will be impossible to balance the budget by raising taxes. Spending must be curbed. A few years back there was a "1% plan" that claimed to balance the budget in 5 years by simply reducing spending by 1% in actual dollars each year for 5 years.

ReplyDeleteLaurie,

ReplyDeleteI have been for Fair Definition #3 for a long time...

Unfortunately Liberals seem to like Fair Definition #4

"1.Fair would be if we took the total cost of government, divided it by the number of adult able bodied citizens. And each adult then paid their fair share of the bill. (ie Dues concept)

2.Fair would be if total cost of government was divided by the total income of every adult able bodied citizen. And each citizen paid their fair share of the bill. (ie Percent of Winnings to the House Concept)

3.Fair would be if total cost of government was divided by the total income - some base living cost (~$25,000?) of every adult able bodied citizen. And each citizen paid their fair share of the bill for every $ they make above the base living. (ie Percent of Winnings above Base Cost to the House Concept)

4.Fair would be if taxes and credits/programs were set to reduce the net income and wealth gap between the adult able bodied citizens. This means high income and wealthy people pay significantly higher rates than other citizens in attempt to attain a fair society.(ie Equalization concept)"

Jerry,

ReplyDeleteWhat programs do you think have a 50% waste level?

Most of the US spend is the military and sending checks sent out to citizens or health care providers...

Not much waste there.

Seriously, where do you get this stuff?

There is a simple solution-- a flat tax with a "family" exclusion.

ReplyDeleteThe dirty little secret about the flat tax is that properly enforced, rich people would pay a lot more in taxes.

While we don't have a flat tax, the tax we do have is flattish. It makes perfect sense to bump up the rates of rich people a bit, because rich people have greater access to and benefit more from tax breaks.

--Hiram

"The Effective Tax Rates by Income Here explain it better."

ReplyDeleteThat's only federal income taxes. If you include the rest of federal taxes as well as state and local taxes, the system is less progressive.

I do agree that one's entire tax situation must be considered.

ReplyDeleteAs I understand it, progressivitiy in taxes means the more you make the more you pay. If that's the case, there is nothing at all inherently unprogressive about a flat tax. What seems to disputed is the amount of progressivity. For me, it's a relatively minor issue because the changing rates has only a small impact on progressivity. What has far more impact on progressivity are various tax breaks. Bear in mind, that while tax rates are only mildly progressive, tax breaks are more aggressively regressive. That's because they are more available to high income earners, and also because they typically come off the top where marginal rates are highest.

--Hiram

I would not call fair definition 3 progressive.

ReplyDeleteabout cutting spending- I think there is very little in terms of spending cuts that has widespread support. If cutting spending was easy or popular the GOP would be doing it right now, when they have full control of the fed govt.

to me it is clear that the deficit can be reduced solely by raising taxes. We could start by repealing the recent trump /gop tax cut.

Sean, Yes that is true. On the other hand people on the lower end of the spectrum also get the most direct aid from the government. (ie welfare, medicaid, refundable tax credits, etc)

ReplyDeleteHiram, Those types of issues should be in the effective tax rate numbers. Also, please remember that Earned Income Tax Credit, Child Tax Credit, etc all phase out and only help low income folks.

Laurie,

In number 3 people who make little pay NO tax, how can you call that not progressive.

The GOP could not cut anything... They do not have 60 votes in the Senate.

Those types of issues should be in the effective tax rate numbers. Also, please remember that Earned Income Tax Credit, Child Tax Credit, etc all phase out and only help low income folks.

ReplyDeleteTax cuts benefit the rich to a really incredible amount. Millions and millions of dollars. It's why they work so aggressively to elect Republicans. Somehow the child tax credit just doesn't compare.

--Hiram

Hiram,

ReplyDeleteThe thing you are forgetting is that those cuts you hold against the wealthy just make the system a little less progressive, the successful are still paying most of our country's bills.

And I am thinking a family with Mom, Dad, 3 Kids, $50,000 income and a mortgage appreciate the $6,000 child tax credit more than the wealthy person appreciates a slightly lower rate.

The irony is that most of us don't even pay an amount that covers the costs government spends for us. Just think of how many costs the family described above incurs when they have 3 kids in school.

And yet Liberals complain about how unfair things are... Instead of being thankful that some of our citizens are paying millions of dollars per year in taxes so we don't need to pay so much.

I made up some numbers re how much would one pay at different incomes according to your preferred form of fairness as I understand it. It is only progressive at the bottom of income levels.

ReplyDelete$10,000 nothing

$100,000 14%

$1,000,000 15%

$10,000,000 15%

$1,000,000,000 15%

I think someone who makes $10,000,000 or $1,000,000,000 should pay a much higher %

Laurie,

ReplyDeleteRead it again.

3.Fair would be if total cost of government was divided by the total income - some base living cost (~$25,000?) of every adult able bodied citizen. And each citizen paid their fair share of the bill for every $ they make above the base living. (ie Percent of Winnings above Base Cost to the House Concept)

Everyone would pay $0 on their first $25,000 if single and $50,000 if married. So most people would pay little or nothing like today...

A couple who makes $100,000 would only pay on $50,000...

Laurie,

ReplyDeleteNow looking at just a couple of the Motley Fool numbers...

$1 to $25,000 pretty much pays no income tax, maybe 7% for sales tax and 7.5% for FICA, but they get that or more back in Medicare, SNAP, tax credits, etc. So in essence they pay $0 to maintain our wonderful country.

$25,000 to $50,000 pretty much pays ~$2,000 for income tax, maybe 7% for sales tax and 7.5% for FICA, but they get much of that back tax credits, etc. So in essence they pay a few thousand dollars per year to maintain our wonderful country.

$200,000 to $500,000 ~$55,000 for income tax, maybe 7% for sales tax, some big property tax bill and 7.5% for FICA on the first ~$110K, and they get little back in credits. etc. So in essence they pay a 10's of thousand of dollars per year to maintain our wonderful country.

And on and on until we back to individuals who are paying millions of dollars per year... Now what is unfair about our current tax system.

Your explanation makes no sense to me. What rate of income tax are you using and is it the same for every dollar above the exempted amount? you seem to be focused on the fact that richer people pay more $. For a tax system to be progressive they need to pay a higher % of their income as their income increases. Would someone earning a million dollars pay a higher tax rate than someone earning $100,000. Of course they pay more if you focus on the dollar amt of taxes paid rather than their tax rate.

ReplyDeleteIf every married couple got the first 50,000 free... And everyone paid 25% over that...

ReplyDelete$0 to $50,000 would pay 0%

$100,000 households would pay only pay 25% on their second $50,000

Meaning they would only pay $12,500... or 12.5% on their $100K.

$1,000,000 households would pay 25% on $950,000

Meaning they would only pay $237,500... or 23.75% on their $1M.

The math works which ever the rate is set to.

So why do you think #4 is fair?

ReplyDelete4.Fair would be if taxes and credits/programs were set to reduce the net income and wealth gap between the adult able bodied citizens. This means high income and wealthy people pay significantly higher rates than other citizens in attempt to attain a fair society.(ie Equalization concept)"

Remember that 3 is somewhat progressive like today. 4 is where Liberals seem to want things to go.

Things your universal income idea where people would be paid for just being in America. Whether they learn, work, save, invest, etc or if they just squander the gifts that America offers all of us.

And of course those who learn, work, save, invest, etc would be handed the bill in this system.

The thing you are forgetting is that those cuts you hold against the wealthy just make the system a little less progressive, the successful are still paying most of our country's bills.

ReplyDeleteIt's hard to make a claim that the system is very progressive when you consider that the rate we pay doesn't have a lot to do with the marginal rate on the tax table. What really affects the check we right are how we benefit from various tax breaks.

And I am thinking a family with Mom, Dad, 3 Kids, $50,000 income and a mortgage appreciate the $6,000 child tax credit more than the wealthy person appreciates a slightly lower rate.

I am sure a rich person benefits the millions of dollars he receives in tax breaks. I will leave it to explain why it's not their tears of gratitude we are shown at Trump campaign rallies and the expensive commercials they pay for.

Poor people pay in other ways. Trump talks frequently about first responders. How many of them got their jobs after receiving a million dollar gift from Daddy? How many of them received billion of dollars in discharged debt paid for by hard working people who entrusted him with their savings?

==Hiram

Hiram,

ReplyDeleteThose are not marginal rates. They are effective tax rates. Why is it so hard for you to believe our tax system is for the most part pretty progressive?

Now I realize it is not as progressive as progressives would like, but that is a different issue.

Some related links.

Tax Foundation

Tax Policy Center

I mean the only tax where everyone pays their fair share is FICA. And that is because it is an insurance program that charges premiums for benefits.

Now I agree that it is wrong that people can escape paying capital gains taxes by dying, but otherwise our system is pretty progressive.

ReplyDeleteUnless you have a source that disagrees.

Eliminate all taxes in favor of a single flat rate on consumption above the "poverty level." That is, a fixed rate on disposable income. That tax (the FAIR tax) is perfectly progressive and fair to everybody and has too many other advantages to count. Everything else is tinkering around the edges. Yes, a flat tax has similar advantages, but leaves in place things like FICA which are REGRESSIVE taxes.

ReplyDeleteForbes Tax Comparisons

ReplyDeleteI don't think fair or flat are progressive enough to make Liberals happy. They want to the rich to pay most of our bills.

And of course FICA is no more regressive than any other insurance premium. Your benefits are based on how much you pay in.

Why is it so hard for you to believe our tax system is for the most part pretty progressive?

ReplyDeleteBecause I know how money works. For wealthy people, their wealth increases through various that way that protect or avoid the generation of income.

--Hiram

The actual income tax rates are more progressive than the system you say you prefer. If we were to use your less progressive system we would have a larger deficit. If it were up to me these tax rates would be more progressive and we would have a smaller deficit.

ReplyDelete2018 Income Tax Brackets

Rate Individuals Married Filing Jointly

10% Up to $9,525 Up to $19,050

12% $9,526 to $38,700 $19,051 to $77,400

22% 38,701 to $82,500 $77,401 to $165,000

24% $82,501 to $157,500 $165,001 to $315,000

32% $157,501 to $200,000 $315,001 to $400,000

35% $200,001 to $500,000 $400,001 to $600,000

37% over $500,000 over $600,000

Hiram

ReplyDeleteSource please... Other than "you know".

Laurie,

As I said, the math works for any percentage. I just grabbed 25% for easy math.

Now back to...

So why do you think #4 is fair?

4.Fair would be if taxes and credits/programs were set to reduce the net income and wealth gap between the adult able bodied citizens. This means high income and wealthy people pay significantly higher rates than other citizens in attempt to attain a fair society.(ie Equalization concept)"

Remember that 3 is somewhat progressive like today. 4 is where Liberals seem to want things to go.

Things your universal income idea where people would be paid for just being in America. Whether they learn, work, save, invest, etc or if they just squander the gifts that America offers all of us.

And of course those who learn, work, save, invest, etc would be handed the bill in this system.

You do understand that it is the income gap that creates economic growth, do you not? People work to get rich (or richer), which means they can buy more stuff, and that increases production and lowers costs so more people can afford that "better standard of living." Meanwhile, the rich invest in the means of production and give people jobs so they can make more money and buy the stuff they produce ( Henry Ford's theory). Of course you could punish inequality, but who gets hurt?

ReplyDeleteThe dream of liberals is that government bureaucrats are so much smarter than all of us collectively, making individual decisions, that Utopian society results.

Put it another way. Say you make X$. Is it "fair" or reasonable that Senator Highpockets gets to tell you how much of it to give to your worthless neighbor? And oh, by the way, "borrows" half of it from your kids?

Here's another math experiment for you. Simply assume government confiscates all the income of the top 1% and applies it against the federal deficit. What will the deficit be in the first year? in the second year?

ReplyDeleteThe Balance

ReplyDeleteSource please... Other than "you know".

ReplyDeleteBill Gates has 50 billion dollars. It's in stock he got for free. How much income tax has he paid for that stock? Zero. because he hasn't sold it. So what is his effective tax rate?

That's the way taxes work. That's how wealthy people get wealthy.

--Hiram

You do understand that it is the income gap that creates economic growth, do you not?

ReplyDeleteNo. Trump makes a lot of money, but he has cost the rest of us billions. How much did you lose in Trump's bankruptcies? I don't have the exact figures, but it was a bundle.

--Hiram

My employer has an incredible 401k program. They pass out huge sums of money to employees tax free to them, but tax deductible to the company. They do it because it's a way to compensate already highly compensated executives. In tax terms, this plan is invisible. It doesn't show up on the 1040.

ReplyDeleteHow does this appear when calculating effective tax rate? Is the money added in? Is the appreciation?

--Hiram

Simply assume government confiscates all the income of the top 1% and applies it against the federal deficit.

ReplyDeleteI don't know. It's not a policy I advocate. The deficit battle is one I always win when Republicans are in charge because it's quite obvious that they don't care. The thing of it is, balanced budgets have no constituency. They hire no lobbyists. They make no contributions to any campaign. They can't be counted on to go door knocking in October. They don't vote. That being the case, they just don't have much influence on politicians.

--Hiram

You will be glad to know, then, that there is strong sentiment for convening and "Article V Convention of the States" to force a balanced budget amendment into the Constitution, bypassing Congress. Oh, the horror!

ReplyDeleteHiram,

ReplyDeleteAs noted earlier I do agree regarding "that it is wrong that people can escape paying capital gains taxes by dying, but otherwise our system is pretty progressive."

As for taxing gains before they are sold or complaining about 401Ks and IRAs... That I can not agree with. Every citizen should be making good use of these excellent retirement preparation tools.

That also applies to Bill Gate's stock, it is simply an asset that can gain or lose value until he sells it. If Microsoft stops offering excellent value to our society and customers, they could go bankrupt and the value of his wealth would plummet. Our society has a vested interest in supporting ownership and investment.

Too bad more people do not do it.

Jerry,

ReplyDeleteWe will believe the convention is a reality when we see it. I hope you are correct.

What did you all think of the Balance piece?

ReplyDeleteif that Article V convention were restricted to the balanced budget amendment, I would say it was an excellent way, and perhaps the only way, of getting that done. Unfortunately the current push is NOT so limited, making room for endless mischief. I oppose it. Even if it were so limited and did in fact pass – I expect approval by three fourths of the states to come easily since 49 of them already abide by such – I can only imagine the uproar in Congress when those hard decisions have to be made. Congress is really not very good at saying "no" to anybody. I still say the easiest solution is radical reform of the tax system, or of entitlement programs, or both.

ReplyDeleteIt should be noticed that the vast bulk of Bill Gates' wealth is now controlled by the Bill and Melinda Gates foundation, where it is and will remain tax-free. He could have simply given all that money to the government and let them "do good" with it. Ever wonder why he did not?

As for the "balance article" I found it biased and unrealistic. that is, it seems to identify the problem without proposing any workable solution.

This sounds familiar...

ReplyDelete"it seems to identify the problem without proposing any workable solution."

Do you have a real unbiased source that provides a "workable solution"?

Here is what I just posted at MP...

"I have been trying to find a good piece regarding what it would take to reduce the National Debt as a percentage of the nations GDP... This one is okay.

The Balance

Does anyone have a better source?

It looks like we need to:

- grow the GDP faster

- tax wisely (ie taxes that do not stymie growth)

- spend wisely (ie investments that pay back)

Otherwise we just keep borrowing on our children's credit card. :-("

As for taxing gains before they are sold or complaining about 401Ks and IRAs... That I can not agree with. Every citizen should be making good use of these excellent retirement preparation tools.

ReplyDeleteI am not criticizing the policy, at least not here. But that fact that huge gains in wealth go untaxed pretty much undermine the notion that our tax system is aggressively progressive.

I watch early morning tv, and I have noticed that the same commercials are run at the same time each day. There is one for an accounting firm BDO, that I swear could have been produced by the Democratic Party. In it, a daughter is discussing estate planning with her father who is worried about estate taxes. He has evidently been listening to Republican fear mongers. She is carefully explaining to him that their accountant, BDO, has come up with tax devices that will allow the old man to avoid estate taxes altogether. So much for an essential Republican argument they have been using to win elections for going on decades now.

--Hiram

The idea of having to pay 40+% of one's estate to the government just because you have owned the property for decades is pretty scary. No GOP scary stories required. It is a complicated concept.

ReplyDeleteI have friends who have used some of these techniques with their family farms.

ReplyDeleteThe number of family farms that are forced to pay the federal estate tax is miniscule. It should also be pointed out that farm property has special rules regarding its valuation that can lower its value compared to retail/commercial/residential property. It's also true that estates that are at least 35% farm (and used as a farm after the death) can have their estate paid off over a 15-year period instead of in nine months.

ReplyDeleteBe it farms, vacation properties, or other long held family assets that just appreciate with inflation... I am not sure it makes much sense to tax the "value change". I mean the person is already paying property taxes, income taxes if the asset makes a profit, etc.

ReplyDeleteAnd it sure does not make sense if there so many loop holes...

It is especially odd that MN has a state death tax. To me that is just a good way to convince wealthy folks to seek new residence states in their golden years. Well for at least 6 months and 1 day of each year.

If we're going to have one at the state level, it should at very least conform with the federal tax, which it does not currently.

ReplyDeleteThe idea of having to pay 40+% of one's estate to the government just because you have owned the property for decades is pretty scary.

ReplyDeleteThe idea that one can accumulate one of the great fortunes of history without paying any taxes at all, is kind of disturbing as well. Estate taxes in many situations are pretty easy to avoid. Just ask BDO about that. In the way we are accustomed to thinking about taxes, appreciation of wealth should be taxed, it's just not that easy to do. That's why there are such huge, easily exploitable loopholes.

--Hiram

I think for someone who cares about the deficit voting for Trump and the GOP was a mistake.

ReplyDeleteDeficit to top $1 trillion per year by 2020, CBO says

Yes it is hard for me to say... But Hillary would have been much better in this area as long as the GOP stayed controlling the House.

ReplyDeleteThe tax cut would not have happened...

And the GOP congress would have stopped her from raising spending...

Perfect except that I would have to listen to you complaining for another 4 years that the GOP was the obstructionist party... :-), :-), :-)

Let's just keep praying that the 3+% GDP growth shows up for awhile before the next recession.

if Hillary had won the electoral college it would be the tea party and the gop base all hyped up to vote in the midterms.

ReplyDeleteThe one good thing about Trump is he is good for democrats up and down the ticket in the 2018 election.

Agreed. Imagine how frustrated Trump will be in 2019 if the House and Senate go DEM...

ReplyDeleteThe Dems need a miracle to retake the Senate in November, but taking the House will be sufficient to give Trump all the trouble he deserves.

ReplyDeleteCurbing the deficit is easy. Restrict spending to the current dollar value, minus 1%, each year for the next 5. Done.

ReplyDeleteOr, pass the FAIR tax, vastly curbing the trade deficit, reforming SS, increasing savings and capital formation and investment to grow the economy, saving hundreds of billions of dollars in compliance costs and IRS "overhead," among other good things.

Or reform Social Security, Medicare and Medicaid-- the three biggest drivers of deficits-- programs that will doom us if left as is. By 2025, it is predicted that these three programs, plus interest on the debt, will consume all tax revenues. Try balancing the budget THEN.

Who restricts spending? Why it's the spenders? I think there is a problem there.

ReplyDeleteOurs is a government of men and women, not laws. And if the people we elect mess up, there is no one who will save us. Think about that the next time you go into the polling booth.

--Hiram

Jerry,

ReplyDeleteDo you have any source that proves your ideas could work?

Personally I like the idea of cutting SS and Medicare benefits by 25% immediately... You paid to low of a premium for decades... You get less benefit... That would be appropriate consequence for those who vote to keep payroll tax rates low.

Perhaps we do not need a balanced budget amendment to restrict the insatiable spending appetite Of Congress. Every year they hold at least one vote to increase the debt ceiling. If by some political voodoo we could convince a majority to vote no, deficit spending would end immediately.

ReplyDeleteOne other option, offered by those libertarian opponents of the Federal Reserve System: simply return the Constitutional authority of Congress as the only ones who can print money. Right now the Federal Reserve simply buys up any unsold US bonds that fund the deficit and "prints" the money to cover it. If those bonds could not be sold on the open market the deficit could not be funded, or interest rates would climb so high as to create A political Firestorm.

Simple math for the 1% plan.

ReplyDeleteComplex math for the FAIR tax, but qualitatively unassailable.

Reform of the major drivers of debt and deficits, the mathematics obviously depend upon the reform chosen, but it comes under the heading of "must be done." continuing the status quo is simply not an option.

The math for "just raise taxes" to cover the spend is pretty simple also...

ReplyDeleteHowever the devils as always are in the details.

except that we do not have a tax problem. We have a spending problem. if you want to do the math, we COULD raise taxes to eliminate the debt and all the Underfunding of Social Security, Medicare and Medicaid by simply raising the federal tax rate to 100% for the next eight years and dedicating it to that purpose. Simple.

ReplyDeleteSource?

ReplyDeleteOn the surface your statement seems just silly Chart 1.

From Minnpost

ReplyDelete"Now we know that for the most part the US tax system is progressive, maybe not as progressive as some would wish. (see my 4 fairness definitions above) The reality is that the wealthy make a lot of money, but they also pay most of our bills for better or worse. So I do not understand the concept of government wealth transfer from poor to rich?

We consumers freely give our money to people who offer us the best personal value. Be it for a car, a home, a mortgage, at Walmart, software, etc... And if that company or person uses that freely given money wisely and continues to satisfy their customers, they get and stay wealthy. In essence we consumers demand results and improvements or we spend the money elsewhere.

Now if you think it is acceptable that parents have more children than they can raise responsibly, I will have to disagree with you. I think children are entitled to qualified competent and responsible parents. And I think it is society's responsible to ensure they have them. Not to just send checks from some one else's wallet." G2A

I suggest you find your own source by simply doing the math. Find the total debt plus unfunded liabilities, divide by the GDP and figure how many years it would take to pay that off at any given tax rate.

ReplyDeleteContinued over here.

ReplyDeleteThe reality is that the wealthy make a lot of money, but they also pay most of our bills for better or worse. So I do not understand the concept of government wealth transfer from poor to rich?

ReplyDeleteI suppose the argument is that the wealthy get the benefit. The federal government is an insurance company with an army. Wealthy people have a lot of stuff, so they benefit a lot from the military that protects it. With respect to Social Security, wealthy people pay a lot in Social Security taxes but they also benefit from the labor they receive in exchange.

--Hiram

Is your stuff and freedoms any less important to you?

ReplyDeleteAre the pay checks we get less important to us?

I think some of these rich folk are a lot greedier than I am. When I think about Trump, I am just boggled by this overwhelming sense of entitlement he seems to have.

ReplyDelete--Hiram

"So I do not understand the concept of government wealth transfer from poor to rich?"

ReplyDeleteI don't either. I that we shouldn't be destroying the ability of the poor to accumulate wealth in order to benefit those who are already rich.

Please elaborate...

ReplyDeleteWe give everyone:

- a free education

We give many people:

- food

- medical care

- housing

At some point the unsuccessful folks need to change their beliefs, behaviors, etc or they will stay unsuccessful.

This may fit well here. CNN Trump and Work Reqts

I don't think we should be destroying the ability of anybody to get rich, and taxing the rich too heavily is one way to make all of us poorer. It is one of the beauties of the consumption tax that we penalize lavish living, rather than the quiet investor creating jobs, wealth, and products people want and need.

ReplyDeleteA. The consumption tax is NOT going to happen.

ReplyDeleteB. Our economy is based on consumption, are you trying to kill it?

One particular form of consumption tax, the FAIR tax, SHOULD happen. Since it first eliminates all income, sales, estate, gift and FICA taxes, and then rebates the tax to EVERYBODY based on poverty level and family size, it eliminates all taxes on the poor (including the highly regressive FICA), and actually subsidizes those spending below the poverty line. Above poverty level it is perfectly progressive, so only the richest pay close to the nominal rate (average households would pay about half). It encourages savings and investment (every savings account becomes an IRA) and grows the economy. Social Security reform is automatic. The massive overhead of the IRS would disappear.

ReplyDeleteThe only reason this may never pass is because the politicians would have to give up their chance to micromanage and social engineer (and grant special favors) through the tax code.

"Please elaborate..."

ReplyDeleteSure. In the most simplest terms, we tax labor income at a higher rate than capital income. Who does that give an advantage to?

Capital formation and economic growth.

ReplyDeleteAt the expense of the people who actually drive the economy, middle and lower class consumers.

ReplyDeleteMoose

Sean,

ReplyDeleteBut how is that

"we shouldn't be destroying the ability of the poor to accumulate wealth in order to benefit those who are already rich"

I mean every saver/investor benefits, and the poor have tax rates are much lower than the capital gains rates, especially if AMT kicks in.

You guys always say that work is the most important thing. Yet, the stereotypical "white working class" guy working in the coal mine or on the manufacturing floor faces a higher marginal tax hit than the trust fund baby who sits on their butt cashing in on their parents' or grandparents' hard work. We finance those trust fund babies by skimping on the things that would really help working class families -- giving them strong K-12 public education and making it easier to afford a college education, funding transportation infrastructure, and making sure people had access to health care.

ReplyDeleteIf work is the most important thing, then let's make our tax code reflect it.

Now that is some interesting stereotyping. I personally have not found type A workaholic investment oriented parents to be very tolerant of kids who sit on their butt or one's who waste money.

ReplyDeleteAnd if the few who do squander the family wealth, it is paying the wages of a whole lot of service industry employees.

Capital Gains Info

"Taxes on long term capital gains (on assets held for at least a year) are imposed at rates that correspond to pre-2018 brackets: a 0% rate for those whose income placed them in the regular 15% bracket or less (now in the 12% bracket), and 15% for taxpayers in higher brackets, except for those in the 39.6% bracket. The tax revision adopted in December of 2018"

MF Capital Gains

ReplyDeleteI find it amazing that lower income folks pay 0% on Capital gains.

And don't forget about the Alternative Minimum Tax

My Father kept warning me that it was going to get me... I kept reminding him that I am middle class unlike him... :-)

Nothing you've posted here rebuts my point.

ReplyDeleteFrom MP

ReplyDelete"I am happy to simplify the tax code, most people seem against doing so. These are some interesting reminder about Capital Gains and AMT. Did you know the Capital Gains rate starts at 0%... Now that is a progressive tax.

https://www.fool.com/taxes/2017/12/22/your-guide-to-capital-gains-taxes-in-2018.aspx

https://www.thebalance.com/alternative-minimum-tax-amt-who-has-to-pay-3305784

Here is what I proposed, unfortunately neither Liberals or Conservatives seem to approve. They both care more about the adults. (ie public employees and/or parents)

http://give2attain.blogspot.com/2017/01/how-to-win-war-on-poverty.html

You should have heard my Conservative friends howl when I recommended allowing Teachers to grade Parents on simple things like attendance, homework completion, child clean / fed, attendance at Teacher conferences, etc. And then tying that grade to taxes or welfare payments...

Sean,

ReplyDeleteI guess I think it does.

Many capital gains rates are higher than income tax rates... Especially if AMT kicks in.

Well, sure, in some cases that's true. I was making a broad generalization. But the now-legendary tale of Warren Buffet's secretary paying a higher tax rate than him is in fact true and in fact reflects a reality that it's extremely common for very rich people to pay less of their income (rate, of course) in federal taxes than middle-income folks.

ReplyDeleteIf we value work so highly, why do we disadvantage it in the tax code? Any business venture needs both capital and labor, yet our laws are heavily tilted to favor capital.

"Now that is some interesting stereotyping. I personally have not found type A workaholic investment oriented parents to be very tolerant of kids who sit on their butt or one's who waste money. "

ReplyDeleteRepublicans just doubled the estate tax exemption. Way to crack down!

As for the Buffett situation.

ReplyDeleteFrom my research it seemed he added his Secretary's Income tax rate and Payroll tax rate. Which seems wrong to me since everyone assumes they are going to get that FICA money back like any investment / insurance premium.

Secondly, I found no record of how much charitable giving Buffett did to get his rate down to that lower amount.

Finally, I assume his secretary is in the 25% bracket... Not the 0%, 10% or 15%...

Well I know that my Father would prefer to keep the family businesses in the family rather than give a chunk of them to the government.

ReplyDeleteJust as you would like to give a chunk of them to a single mom with 3 kids...

I am not sure which is better for our nation.

"Well I know that my Father would prefer to keep the family businesses in the family rather than give a chunk of them to the government."

ReplyDeleteThat's all well and good, but that's not sufficient basis for public policy.

It probably makes for better policy than giving the money to people with a penchant for making poor decisions.

ReplyDeleteWouldn't it be great if Buffett's secretary and Buffet both were exempt from income, FICA, and estate taxes and paid only a perfectly progressive rate on their consumption? Warren no doubt lives "higher on the hog" than his secretary, and so would pay both a higher rate and higher dollars. The secretary would no doubt pay a much lower rate-- even moreso because of the FICA and family necessity exclusions.

ReplyDeleteI don't think you have studied Buffett's spending habits... Or lack there of...

ReplyDeleteExcuse me, but if in fact billionaire Buffett lives the same quiet lifestyle as his secretary (which is VERY hard to imagine), then his consumption taxes would be the same, as it should be. The only reason we ENVY the rich is that they have more "toys" than the rest of us.

ReplyDeleteI am not sure people envy the rich as much as they believe

ReplyDelete"people who have the most in part due to our society should pay the most to maintain that society"

Are You a Self Made Person?

You are correct. I believe Democrats and liberals actually HATE the rich, including themselves, which is why they insist on punitive tax rates for them. A balanced budget amendment is not going to create a balanced budget unless spending is brought under control. It cannot be done by just increasing taxes, and certainly not by increasing taxes that are already grossly unfair to rich people (or intended to be).

ReplyDeleteNope.

ReplyDeleteWe don't hate the rich. We just understand that a small percentage of the 1% are self-made, while the many are self-made in their minds only.

They made their money because the country in which they live allowed them the opportunity. We liberals expect them to have a sense of obligation to that country that helped them become so wealthy.

Why are you anti-America?

Moose

Moose,

ReplyDeleteYou want to reduce the financial incentive for people to learn, work hard, take chances, save, invest, make good life choices, etc...

You want to reward who don't learn, don't work hard, don't strive, don't save, don't make good life choices, etc by giving them money and services with few expectations...

Why are you anti-America?

It was just an inappropriate question. We are all pro-American... We just have different ideas on how to keep America strong.

"It was just an inappropriate question."

ReplyDeleteIt's not an inappropriate question. If you don't want those who benefit from this society and country to pay back to this society and country, you are not FOR this society and country at all.

"You want to reward who don't learn, don't work hard, don't strive, don't save, don't make good life choices, etc by giving them money and services with few expectations..."

I want all people housed, fed, and provided health care, regardless of their qualifications. I know, I'm a monster.

Moose

"the country in which they live allowed them the opportunity." But... this country supposedly offers EVERYBODY an opportunity. What you want to do is to create equal RESULTS, without anyone having to work for it. That way lies disaster.

ReplyDeleteYou want everybody to have all the benefits, but have no way for those goodies to be paid for without stealing from somebody else. It is at best a zero sum game. You cannot make the poor rich by impoverishing the rich.

There you go, listing qualifications for the benefits of the wealthiest nation in the history of nations.

ReplyDeleteI don't care how it gets done. The difference between you and me is that I want it to get done.

Moose

Moose,

ReplyDeleteThe reality is that the people you are accusing of not paying back are paying far far far more than you do each year... How much payment would be enough for you to be satisfied? Or is Jerry correct that you will not be happy until their net worth is under $1 million? (ie middle class)

Rewarding sloth and poor choices is a way to ensure we have more sloth and poor choices. I am fine paying them for improvement, effort and good decisions.

Jerry,

You are correct... " this country supposedly offers"...

People with silver spoon have much better opportunities.

Moose,

ReplyDeleteNow I am being serious here, let's say that you were responsible for a 17 year old young adult who struggled to make good decisions.

Would you honestly just keep giving them money from your wallet without holding them accountable for learning, working, making good decisions, etc?

Let's say that they screw around and make a baby. Are you going to take on giving both the young adult and the baby money with no requirements? If they make another baby?

Or what if they get addicted to drugs, gambling, smoking, etc? Will you continue to pay to support their poor life choices?

Now let's say that you are fine giving them money to support them, their kids, their habits, etc... How have you really helped this young adult to learn, improve, etc?

How have you helped them to ensure those kids do not follow the same path?

______

Many of the dependent folks unfortunately did not have good role models who taught them about the importance of education, personal finance, smart decision making, etc. I mean being a parent like that is hard, since most people like to keep their kids happy.

However being a responsible parent is about supporting the young adult while forcing them to become independent. That way they will know how to be a capable functional adult when they move away from home.

To keep giving them money without demanding them to mature, learn, improve, etc is a recipe for pain and suffering all around. :-(

As I write this I am thinking about my 23 year old daughter who is now living and working in Oklahoma City. There were many challenging times where the wife and I were not very popular with her over the years. And often it would have been easier to just give in, do her chores, not nag or write a check.

ReplyDeleteHowever thanks to the tough love we gave, today I have the utmost confidence in her education and capabilities as an independent young adult. We are still here when she needs us, however I think it will be a rare occurrence.

I can't imagine where we would be today if we had followed your idea and just wrote checks / let her be... :-(

See what I mean?

ReplyDeleteI say that I want all citizens of this country housed and fed and given health care.

You write volumes on how we shouldn’t do it and that it’s irresponsible to take care of people.

Utter tripe.

Moose

And yet you have no answers regarding the unintended consequences your path leads to... A bunch of people who become trapped in immaturity and dependency...

ReplyDeleteI will never understand why you have so little faith in their ability to learn, improve and thrive as independent responsible contributing citizens.

Learning is problematic. I am often surprised at what people don't know. But I think it's also true that people know what they need to know. And I have also learned not many are interested in history lecture from elitists like me. That's ok. While it might be my job to persuade, it's nobody's job to be persuaded by me.

ReplyDelete--Hiram

Hiram, You also are not giving those individuals $20,000+ per year in goods and services.

ReplyDeleteIf you were, would you expect them to listen, learn, improve and to become independent adult citizens?

Or would you be happy to keep paying while they chose to ignore you?

If you were, would you expect them to listen, learn, improve and to become independent adult citizens?

ReplyDeleteIt's not my job to expect stuff. It's my job to meet expectations.

--Hiram

So when you pay money to someone...

ReplyDeleteYou usually expect nothing of them?

If you give money to a lawn service, you are fine when they miss spots or do not show up some weeks?

If you had an adult child who continually needs cash from you due to their questionable life choices... You would just keep paying without expecting changes and improvements?

"And yet you have no answers regarding the unintended consequences your path leads to..."

ReplyDeleteAnd your answers don't solve the problem or help them. In fact, most of the actions from Republicans take away the things these people need. Of course you say it's to help them. But it doesn't.

Moose

So even though we know without a doubt that treating people like victims and enabling the behaviors that got them to that low point is a terrible thing for them and their children... You would prefer to keep enabling them decade after decade...

ReplyDeleteI would prefer that they hit bottom so they can start climbing back up. I have faith in them.

Holding them trapped just above rock bottom is unusually cruel from my perspective. Just like when an irresponsible or controlling parent fails to help their child become independent. (ie codependency)

Here is an Interesting discussion of Govt and codependency

ReplyDeletePoverty 101

You call it enabling. I call it WE'RE THE RICHEST NATION IN THE HISTORY OF HISTORY and we have people without proper health care and without enough money to feed their children.

ReplyDelete"I would prefer that they hit bottom so they can start climbing back up. I have faith in them."

And when some of those people die because they didn't get the help they needed, I will call your plan evil and unbecoming of a great nation.

Stop making excuses.

Moose

"A bunch of people who become trapped in immaturity and dependency..."

ReplyDeleteThe problem with this argument (as has been discussed before) is that we know that there's not this massive underclass of people just sucking of the teat of government when they could be doing something productive. Most of our "welfare" spend is on children, seniors, and the disabled, while the able-bodied folks tend to cycle through pretty rapidly.

Moose,

ReplyDeleteI am wealthy enough that I could have bought everything for my girls. Wealth is not the point. I know I won't convince you, but at least read the links and think about it.

Sean,

I have to disagree or we would not have so many unlucky and undereducated children in this country who are trapped in generational poverty and broken homes.

Please remember that I am not concerned about the short term spend. I am worried about the longer term hopelessness and even more screwed up kids.

This whole problem is wrapped up in the word "we." If you and I-- "we"-- or you OR I or Moose, decide that we want to give MY/YOUR/OUR money, food, housing, health care to some other individual and ask for nothing in return, that is our choice. The probability is high that we WILL, at some point, ask for some positive behavior in return, and that point is a personal choice. But when "we" is the government, "we" lose all control of those acts of human compassion and gratitude. Entitlement replaces effort. Indolence replaces industry, and resentment replaces respect for self and for others.

ReplyDeleteAnd Sean, you are correct, but: There is massive fraud and waste in the government welfare systems, which Trump has ordered reduced just yesterday, and today we hear of a local millionaire who has been collecting food stamps just to prove the point.

ReplyDeleteYes, many on welfare "need it" and are struggling-- nothing wrong with that but the longer it goes on and the easier it is to get, the less we are actually helping folks towards self-sufficiency. It is too easy to get ON welfare and too hard to get off. That needs to change, and government should strongly encourage and enable that change. OR (eventually) get out of the "charity business" altogether.

'This whole problem is wrapped up in the word "we."'

ReplyDeleteIf we are not 'we', 'we' are not a nation.

We the people...

Again I ask, why are you anti-America?

Moose

"...today we hear of a local millionaire who has been collecting food stamps just to prove the point."

ReplyDeleteThe point proven is that the rich are able to game the system. Shocking, I know!

Moose

Moose,

ReplyDeleteAgain I ask, why are you anti-America?

Continued over here...

ReplyDeleteThe /rich/ are able to game the system? Why is the system capable of being "gamed"?

ReplyDeleteYears ago I looked into getting food stamps and found I could easily do it. I could

-- sell the house and buy a bigger one,

-- sell the car and buy a more expensive one, and

-- spend most of my savings on a lavish vacation.

I didn't.

Apparently the rules have been relaxed a bit since then. How would "we" have benefited if I had?

Any system can be gamed. You're rather naive.

ReplyDeleteMoose

Most states have eliminated asset tests for TANF and SNAP because there's no appreciable benefit. The admin costs in most cases are just as much (or even more) than what gets saved. Virginia, for instance, discovered that it was spending 3x as much in admin than applications it denied. Moreover, not forcing families to sell assets (like cars, which are essential for getting and keeping a job) in order to get aid, they actually saw their caseload drop.

ReplyDeleteCAP: Asset limits are a barrier to economic security and mobility

Sean, that makes good sense, as all public policy should. Unfortunately any hard and fast rules-- typical of government programs-- can be "gamed" or, equally likely, may deny benefits to the truly needy. I was once part of a church group that found those denied welfare and "put them back on their feet." It happens.

ReplyDeleteWhat it points out to me is that the government programs lack discretion (and, I should say, caring) and are /therefore/ generally inefficacious at relieving poverty. Even a cursory review of this millionaire's "plight" would reveal he didn't need the help. Yet it was given. How much would he have collected had he not come forward? Why was there no work requirement for him?

Let's talk basic economics for a moment. The only real wealth comes from people working. To pay people to NOT work is to subtract from total wealth. You cannot balance the nation's budget by taking from somebody and handing it to somebody else. You have to reduce the need for that [generally wasteful] money-shuffling, while adding to the total economic activity.

ReplyDeleteThe gentleman in the case this week was over the age of 65, so he was considered elderly and exempt from work requirements.

ReplyDeleteBut he was still given aid he did not need. I cannot find it right off, but States which have instituted work requirements for food stamps have seen reductions in the rolls, telling us that some folks are taking what they don't need.

ReplyDelete