My Reticular Activating System must be set to notice these types of stories right now. Or it is a very popular topic at this time...

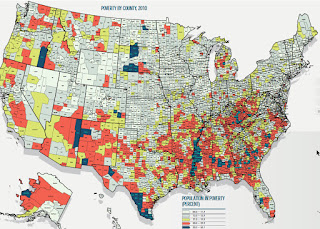

VOX America’s anti-poor tax audits, in one infuriating map: A map from ProPublica shows who the taxman really inspects.

Here are the questions:

Also, Sean posted this interesting test link elsewhere. It is worth trying. I failed... Not sure what that means...

Pick on the map to expand it. Thoughts?

- Do people like me not get audited because I hire someone to do my taxes and don't take any chances? Am I sheltered by my wealth somehow?

- Are poor less educated people simply more prone to making mistakes and triggering computer flags?

- Are agents looking to audit minorities?

- Are they just looking for poor people who don't have the knowledge or resources to fight the audits?

- Why would the GOP states have the most audits? A Liberal conspiracy?

- Other?

Also, Sean posted this interesting test link elsewhere. It is worth trying. I failed... Not sure what that means...

Pick on the map to expand it. Thoughts?

23 comments:

As a society, we've been seasoned to expect tax avoidance and evasion from the rich. It's also easier to pick on poor people who don't have the resources to fight back. If I'm an IRS agent, do I want to spend my time tied up fighting a billionaire in court when I can rack up a bunch of easy wins against poor black people in Alabama?

I am a big fan of Tax Avoidance

But again... I think the computers pick out the questionable returns...

Do you think they are biased?

Here is the IRS criteria

And the more I compare the low income to audit likely maps... They are nearly identical...

CBS Audit

Tax Flags

I added one more image to the post after thinking about it... Of course lower income people account for more of the audits because there are so many more of them... :-)

I guess if there was statistics of the percentage of rich whites audited versus percentage of rich blacks audited, it might tell us something. Or data of audits divided into tax brackets.

Molly

The IRS Criteria link had that.

Returns by Income (% total returns) [% audited 2014]

All returns (100%) [0.86%]

No adj income (1.83%) [5.26%]

$1-$24K (39.08%) [0.93%]

$25–$49K (23.32%) [0.54%]

$50-$74K (13.12%) [0.53%]

$75K–$99K (8.33%) [0.52%]

$100K–$199K (10.70%)[0.65%]

$200K–$499K (2.87%) [1.75%]

$500K–$1M (0.48%) [3.62%]

$1M–$5M (0.24%) [6.21%]

$5M–$10M (0.02%) [10.53%]

$10M+ (0.01%) [16.22%]

Isn't it amazing how the racism is rampant folks can try to mislead us with misleading maps...

The lesson here is that if you claim NO income or a lot of income you may be audited. Which makes sense to me...

Maybe I’m missing something. What I meant was that let’s say in the 50-75k bracket you had 5% of all whites within that tax bracket audited and 12% of all blacks within that tax bracket audited then you might be able to say that there was a bias.

So ProPublica gets to toss out bombs like this and we need to research if it means anything?

"The five counties with the highest audit rates are all predominantly African American, rural counties in the Deep South. The audit rate is also very high in South Texas’ largely Hispanic counties and in counties with Native American reservations, such as in South Dakota. Primarily poor, white counties, such as those in eastern Kentucky in Appalachia, also have elevated audit rates.

The states with the lowest audit rates tend to be home to middle income, largely white populations: places like New Hampshire, Wisconsin and Minnesota. Generally, the IRS audits taxpayers with household income between $50,000 and $100,000 the least."

The story is really about the EITC and the Child Tax Credit and households that get more back than they pay into the income tax system.

More on EITC audits

And then you throw in the relationship between single parent households and poverty...

And the fact that minority households have more single parents and "tadaaaa". It looks like the IRS is biased...

Gotcha, so many moving parts.

Molly

Here is an interesting discussion of the challenge / game

Some more graphs depicting silly potential causations

G2A C is not C

Dilbert Comics

"I guess if there was statistics of the percentage of rich whites audited versus percentage of rich blacks audited, it might tell us something. Or data of audits divided into tax brackets." Molly

So given the correlation and causation challenges...

It is real hard to determine "racism" even if we had those percentages. :-(

The question is always...

Is there some third, fourth or fifth factor out there that is actually at play. :-)

It’s all pretty crazy. Looking at the articles on EITC, first they try to help out poorer households with a credit or in some cases a refund. Then the IRS notices an uptick in fraud and/or people claiming a credit just in case they qualify, so they do more audits on them. Then it starts to look like they are picking on those poorer folks, which in some people’s views could be construed as racism.

Molly

Once long ago I asked why are poor people poor?

And I am guessing that one cause is that they are not CPAs or accountants... So of course people who may have barely survived high school math will be more likely to make mistakes. And therefore trigger the computer flags.

And often these folks get big refund checks because their income and withholding was so small. I had a friend with a daughter who was addicted, then got on a methodone treatment, and was caring for her ~4 year old daughter. She was still so screwed up that she would steal from him/others, struggled to hold down a job, but she did like spring time when she would get a ~$5,000 check from us tax payers because of the child and other credits.

The irony of course was that he was a hard core conservative who was conflicted at all the programs his screwed up dead beat daughter was on.

I thought this an odd discussion, but it has taken an interesting turn. Tell me, where in the 100s of pages of tax forms does one indicate "race"? Somehow, the IRS is targeting people for audit without knowing that vital piece of information?

And if you want to correlate low education with poverty with race, have you seen the tax forms? There is an organization which routinely asks all the IRS offices a relatively simple question, and every office gives a different answer! NOBODY can fill it out correctly!

That is a very good point...

I do not remember race being on the Tax Forms...

With the changes in the current tax law meaning that a large majority of taxpayers (90%+ by some estimates) would be taking the standard deduction, the government could complete the tax return for them, and send it to them for verification but "Big Tax Prep" has successfully lobbied Congress to prevent this from happening.

The tax law changes make it LESS likely that folks will be audited. The blame for the complexity belongs to the innumerable lobbyists that, rather than argue for changes to the law, pay off Congresscritters to alter the tax law to get their special interest favorable treatment, complicating things for everybody. There are now over 800 tax forms to cover all of these credits, exemptions, carryovers, etc., etc., etc.. Even taking the standard deduction, my filing is 32 pages. They can tell me I made a mistake, but they cannot accuse me of cheating because, to break the rules you have to understand the rules and NOBODY understands the rules. We should abolish the IRS and go to the FAIR tax. We would save billions just in prep time.

Support for Sean's Comment

Post a Comment